How to Become an Actuary: Degree Requirements & Certification Exams

The general path, as mentioned earlier, is to complete an undergraduate degree and then start your actuary certification process with one of the two professional bodies in the us, soa or cas.

However, there is no requirement to complete your undergrad before starting the certification exams. Take the first actuarial exam as soon as possible, whether you’re in school or not. This will demonstrate your aptitude for the type of math and other skills required on the job and show recruiters you are serious about your commitment to the industry.

Becoming and maintaining the enrolled actuary designation requires significant effort and skill. The requirements are as follows:

qualifying formal education – a bachelor’s degree where the primary area of study is actuarial mathematics or an equivalent number of hours in studying mathematics, statistics, actuarial science and other representative subjects. Examination – a candidate must successfully complete a series of examinations to demonstrate pension actuarial knowledge. For practitioners working towards the enrolled actuary designation, this tends to be the most difficult requirement. The exams require extensive study and are extremely difficult to complete. In many cases, pension practitioners with years of experience are unable to pass the required exams.

To work as an actuary, you'll need a bachelor's degree as well as certification through a series of exams. If you're still in high school, you can start preparing for your actuary degree and career by enrolling in a college prep curriculum. Take math classes every year, if possible to include advanced placement (ap) classes and courses such as statistics and calculus. Take computer science classes to build your computer skills. Some colleges and universities offer actuarial summer programs for minority high school students to boost their chances for success in the field.

Next, how to become an actuary is the discipline that they undertake. Here are some training criteria that they follow:

three basic requirements- education, experience, and completion of the relevant exams

good hold on mathematics, algebra, and calculus during high school

understanding of economics, business administration, commerce, and computers

should have a graduate degree in economics or business administration or commerce or mathematics.

October 13, 2019 career options 60 views

making plans to become an actuary? good for you. However, before you continue on with those plans, do two things. Get a calendar and mark off the next six to ten years of your life, and make sure you look in the mirror and tell yourself over and over again that you really do love mathematics and/or have math skills as well as an interest in finance. Oh, sorry folks; almost forgot to mention that a bachelor’s degree, certifications, and some on-the-job training are usually some of the more common requirements for this type of career. Well, if this first paragraph hasn’t scared you off, and you’re still determined, remember that when all the blue skies and green lights come back and you have a nice job at some large insurance company making a bucketful of those green pieces of paper with the picture of dead president on the front…. You’ll be happy and glad you chose to become a full-pledged actuary! we’re proud of you.

There is a long series of exams, that takes several years to complete, that is required for certification as a professional actuary. The examination requirements and professional designations differ from country to country but are all similar in the depth and rigor of study required. Here is an outline of the process for those studying to become actuaries in the united states.

An actuary must have a bachelor's degree, whether in mathematics, actuarial science, statistics or a similar field. Coursework typically includes economics, corporate finances and applied statistics. There are a series of exams that you must pass to become an actuary, a process that can take six to 10 years. However, you can start working as an actuarial assistant after you pass the first two exams. The casualty actuarial society and the society of actuaries both sponsor educational programs that lead to certification. They also provide fellowship certification in certain actuarial niches and offer continuing education, which is required to maintain certification.

Why Become an Actuary?

Although qualifying as an actuary is a demanding process, you can expect to be well rewarded for your efforts. Starting salaries are well above other industries, with student actuaries earning an average basic salary of around £35,000. This can rise to around £50,000 for newly qualified actuaries, while senior actuaries can earn over £200,000.

Tweets by @beanactuary.

What does an actuary do? what is their job description? who hires actuaries? what types of actuarial jobs are available? how much do actuaries make? what are actuarial exams?

these are the frequently asked questions many college students ask when considering an actuarial science major. In this video, we discuss some of the traditional actuarial jobs, and highlight other industries that have begun to hire actuaries.

An actuary is essentially an analyst for risk management, doing the math to figure out how risky something might be and determining how best to minimize it in the future. Actuaries are most often needed in the insurance industry where there is a lot of financial risk involved in health insurance, life insurance and home insurance. Here, actuaries use data and a number of factors to determine just how risky an insurance policy is to give to someone.

Even in insurance, the actuary's traditional home, it is becoming more common for actuaries to work in non-traditional roles and contribute to other areas of the business. For example, in some firms actuaries are modeling the sales and distribution process to identify the characteristics of the most effective agents in particular geographies, innovating in the use of big data produced by telematics devices in vehicles, or contributing to the claims process by doing a claim-by-claim analysis to identify which claims have risks of exceeding the expected payment. Most insurers also have actuaries embedded in product management, claims, and individual global risk underwriting.

As children, the question we’re most often asked is: ‘what do you want to be when you grow up?’

prodded by our proud parents and inspired by our own vivid imaginations, the answers we came up with, almost felt automatic: doctor! lawyer!firefighter! but you’ve probably never heard a child say: ‘i want to be an actuary!’ which is a shame, really, considering it’s one of the highest-paying and top-ranking jobs in the world.

The daily job duties which an actuary must complete are quite vast and varied. This individual wears many hats and must be adept with completing various tasks on a daily basis. Although many individuals may be unaware of the responsibilities which an actuary takes on in their job role, the position of actuary is one of an important nature.

What is an Actuary?

if you’re thinking about becoming an actuary in your 30s, 40s, or 50s, you might be wondering if you’ve missed your opportunity. Are you too old? is it too late?

the good news is that you’re definitely not too old nor too late. Lots of people have done this before and managed to successfully switch to the actuarial career.

Alternate job titles: actuarial analyst i | associate actuary | entry actuary | entry level.

An important part of an actuary's professional development involves advancing through a series of exams offered by the casualty actuarial society (cas). As an actuarial assistant, you will receive support throughout your career as an actuary, including:

up to 115 paid study hours per exam

opportunities to take review courses

on–site quiet rooms for studying.

What kind of training is required to become an actuary?

to become an actuary, you must have at least a bachelor’s degree. Many colleges and universities offer actuarial sciences programs that blend business, mathematics, and statistics coursework. You do not have to major in actuarial sciences to become an actuary, but you should choose courses that will build a strong foundation in calculus, statistics, probability, economics, finance, management, and computer science. College is a great time to pursue internships that will give you the opportunity to apply this broad base of knowledge in an actuarial position. Your internship may lead to a job offer after graduation, but at the very least, you will make professional contacts in the field.

If you have shown an interest in the field of actuary science, it is a sure bet you have begun to consider which of the best actuarial science schools or top actuarial science colleges may offer an accredited, proven program that meets your education and https://www.amazon.com/Nutritionist-Fact-Label-Coffee-Mug/dp/B085BNZRLK career objectives. As you begin your search for the best actuarial schools nearby or investigate some of the top actuarial science programs offered online, it is important to recognize that there are many different types of undergraduate degrees that help prepare students to reach for careers as a professional actuary.

Step # 6: attain associateship. (first level actuary)

step # 7: attain fellowship. (fully-qualified actuary)

step # 8: get promoted to management. Please note that these steps don’t always occur in the exact same order for everyone. And many of them will be occurring at the same time as others too (overlap). Throughout the post, i’ll make note of which steps may be all occurring at the same time.

I was 35 when i took my first actuarial exam. Making a career change to become an actuary is a big commitment and it's not easy, but it can happen later in life and be very rewarding. Now that i've moved into my new career, i thought i'd share some insights.

How Does an Actuary Assess Risk?

Actuaries are able to forecast the financial future by analysing past events, assessing the present risks and modelling what could happen in the future. Actuaries need to be skilled mathematicians with keen analytical, project management and problem solving ability.

Successful actuaries also have good business sense, solid oral and written communication skills and strong computer skills. Other valuable assets that can be beneficial on the road to becoming an actuary are self-motivation, creativity, independence, ambition and an ability to work either alone or as a part of a team.

An actuary is a professional with a knack for handling risk and all things unknown. Simply put, an actuary is someone who assesses and manages risk. In addition to this, they predict the likely financial outcome in the event of a risk.

Turning your passion for statistics and love for numbers into a rewarding in-demand career is possible when you choose to become an actuary. Actuaries use their mathematical skills to help organizations assess the financial costs of uncertainty and create policies that will minimize this risk. Actuaries typically work for insurance carriers, but they can also find employment in private corporations, government offices, credit rating bureaus, banks, investment firms, and consulting agencies. It’s projected that actuaries will be in strong demand to help price insurance products, predict policy claims, and respond to potential financial risks. In fact, the bureau of labor statistics shows that the employment of actuaries will skyrocket much faster than average by 26 percent by 2022. Below we’ve created a step-by-step guide you should follow to reach your actuarial goals.

Actuaries have a wide variety of responsibilities to help companies make informed decisions and minimize future risk. These professionals apply skills from various fields, such as statistics, math, and financial theory, and use large volumes of data to produce risk assessments. For those who are wondering how to become an actuary, attaining a degree is an important step; but that is just the beginning of an actuary’s education.

As an actuary, you have to use mathematical equations, statistics, and financial theories to determine the risk and uncertainty of involved financial costs. You have to assess risks and help the company to take measures to minimize the risk. There is a high dependence on computer data modeling software, such as advanced financial modeling and statistics software to crunch data in a short span of time.

Overview

an actuary manages risk. They help organizations plan for the future and protect themselves from loss using analytic skills. The primary skill utilized is working with numbers to identify and analyze trends. By using numbers, the actuary evaluates the likelihood of future events. This is a key role in the fast-changing world with emerging risks and the need for more creative ways to assess them. Thus, it is a profession for the person who has a knack to tackle complex math equations.

Starting Your Actuary Career

Choosing a career in actuarial science is far from limiting. As you gain experience as an actuary other positions become an option. Depending on your education, you can work as an actuarial specialist or actuarial services director -- both of which will likely come close to tripling your starting salary. With a doctorate in actuarial sciences, you can teach in multiple departments or start consulting. Actuaries have plenty of rewarding alternatives.

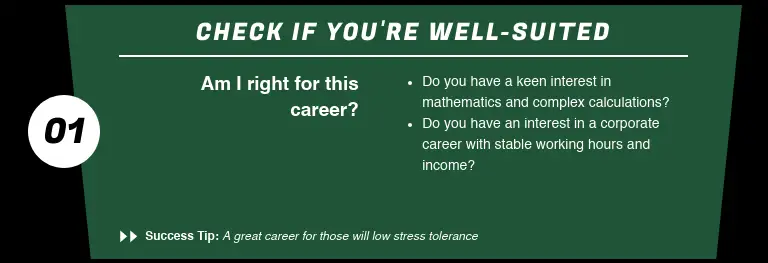

When you really get a chance to think about whether this career suits you. The following comment is cited from public resources. Http://www. Wisdomandwonder. Com/article/4120/what-is-so-bad-about-being-an-actuary

n_asa is just a troll. Ignore all of his posts. If it’s not obvious that he’s just mad he couldn’t hack it, well here’s me telling you that he’s just mad he couldn’t hack it. He either took a terrible actuarial position that paid poorly, took a teaching job that paid ridiculously well, or he comes from a wealthy family and a starting salary that singlehandedly places you above the median family income in most of the cities you would work isn’t good enough for him.

An actuary takes a lot of schooling and will have to take out student loans. They want to make sure the starting salary will be higher than $55,000/year. They randomly sample 30 starting salaries for actuaries and find a p-value of 0. 0392. Use α = 0. 05. Should the student pursue an actuary career?.

Big Data and Actuarial Careers

Actzone_admin actuarialzone leave a comment

in this article, steven armstrong, vice president of pricing analytics & actuarial services, allstate insurance company, and president, cas, shares his journey into actuarial science and why he loves the actuarial career. “at its heart, i love the actuarial career because i love solving real-world problems using a combination of data/analytics, business context, and professionalism/objectivity. While mathematics and technical skills are a big piece of the puzzle, the art of solving problems requires constructing the right question, investigating the data and mathematical techniques to employ, and ultimately communicating results and influencing those who need to know the answer. ”.

Job Prospects for Actuaries

Whether you have thought long and hard about an actuary career or have only just heard of the field of actuarial science for the first time, you might be curious about job prospects with this degree. This interdisciplinary degree program is more specialized than a general mathematics degree program, and its primary objective is to prepare students to become actuaries. However, actuaries hold different job titles as they achieve different levels of professional certification and work in different fields.

The bls reported that employment of actuaries was expected to grow by 22% from 2016 to 2026, which was much faster than the national average for all occupations. The best job prospects would be in health insurance, property/casualty insurance, and consulting. Because there are relatively few open positions, competition can be high; candidates who have completed at least one actuarial exam should have an advantage. In 2018, actuaries earned a median annual wage of $102,880 according to the bls.

How to Become an Actuary in 9 Steps

Find out everything you need to know to take your first steps as a student actuary.

I’m sure you’re liking the sound of that, meanwhile before you take the decision of becoming an actuary, let’s take a look at the steps to becoming an actuary.

If are interested in becoming an actuary, and just wondering about the process as to how to go about actually becoming one, then hopefully this article 'steps to becoming an actuary' will be able to walk you through what steps that you have to take in order to actually finally become a fully qualified actuary in the united kingdom and answer some of your questions.

Once an actuary gains more experience and passes more actuarial exams they’ll be involved in overlooking the work of the entry-level staff and making decisions based on the reports that they provide. They’ll ensure that the methodology and assumptions used seem reasonable. They’ll look at the bigger picture of what their staff is trying to accomplish and then provide the next steps.

What Does an Actuary Do?

How to gain skills, knowledge, and experience

there’s a bustling marketplace for credentialed actuaries. Earning actuary certifications takes planning and work, though, so it’s beneficial to engage in that work throughout one’s undergraduate experience. Though many are employed by companies, some actuaries work as independent consultants. Career paths plug: degrees needed to work as an actuary.

Completing an actuary certification program could earn you the designation of associate or fellow of one of two actuarial societies. The society of actuaries (soa) is the largest professional actuarial group and it's made up of actuaries who work in pensions, employee benefits, and life/health insurance. The casualty actuarial society (cas) is made up of those who work in worker's compensation and liability, car and fire insurance. Each society offers multiple exams that lead to a certification or actuarial credential. Many employers require that you have passed at least one of the initial exams to be considered for employment.

If you’re interested in this career field